Used-Car Price Modeling for Three Rivers Auto

December 7th, 2024 by Michelle Star

This is an abridged version of my Machine Learning final project, where I compare learning models to predict used-car prices and identify the factors that most strongly drive price.

Project brief

Three Rivers Auto asked for two things:

1) understand which features most drive used-car price, and

2) ship a model that predicts price for 1,000 unseen listings.

Data: 1,809 training rows with log(price) and car features; 1,000 test rows without price.

TL;DR

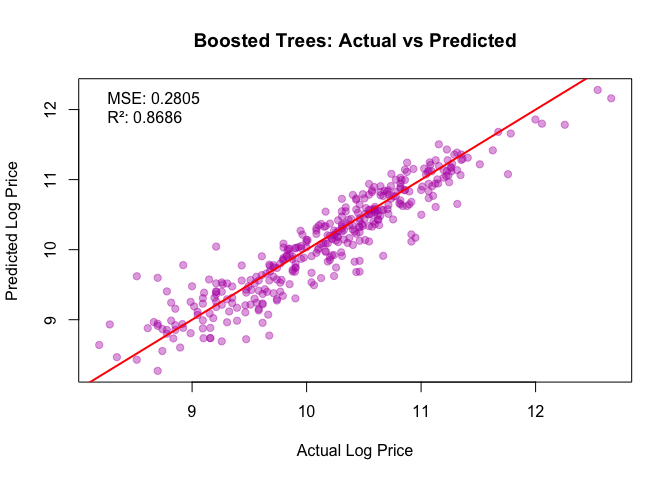

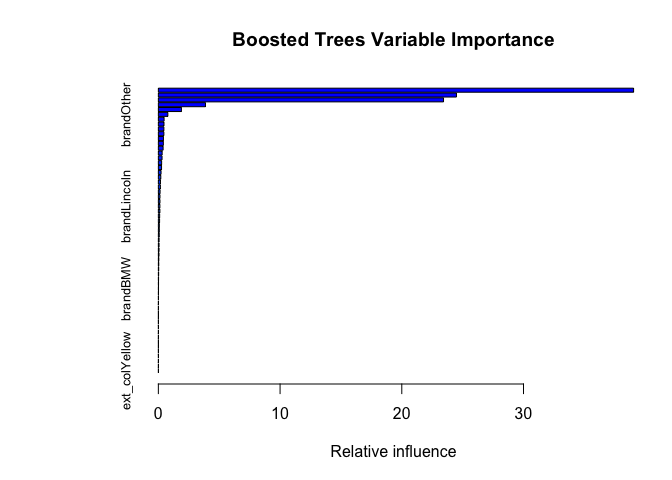

- Best model: Gradient Boosted Trees (GBM) — RMSE 0.2805, R² 0.8686.

- Most important signals: mileage ↓, model year ↑, horsepower ↑ then plateaus, and brand premiums (Porsche, Lexus, Toyota).

- Color, transmission type, and accident flags had limited incremental value.

Dataset and checks

No missing values. Wide ranges for mileage (to 405k) and horsepower (to 760).

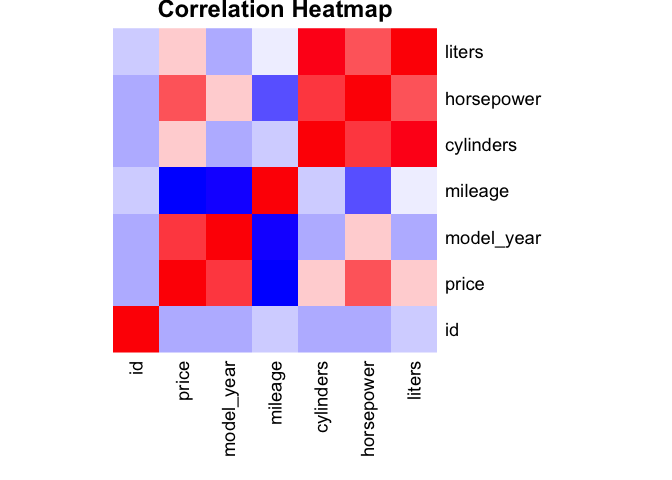

Correlation snapshot:

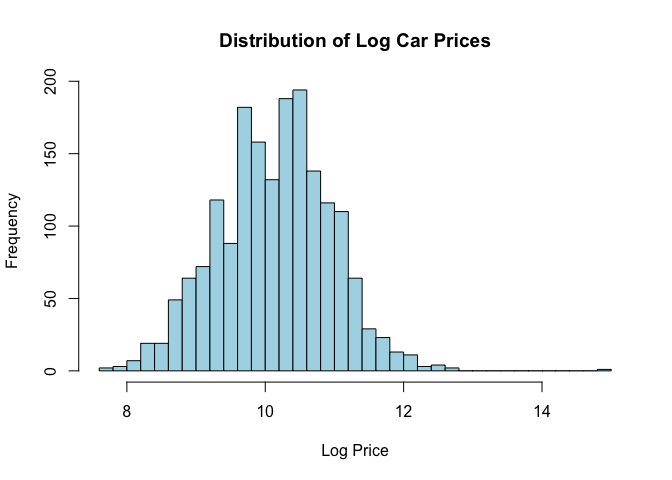

Price is log-scaled. Distribution below:

Exploratory patterns

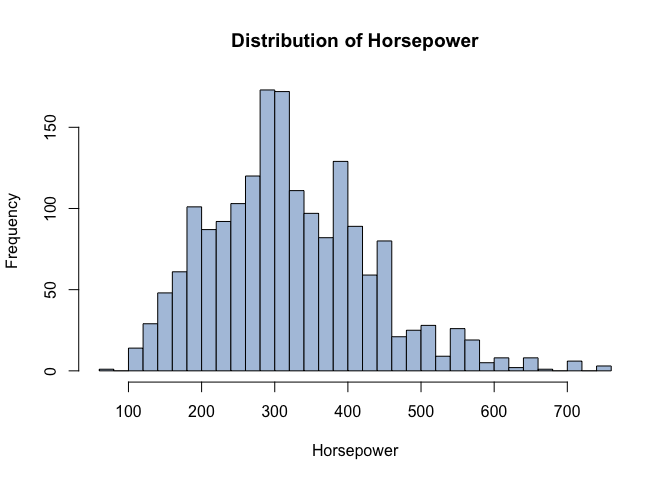

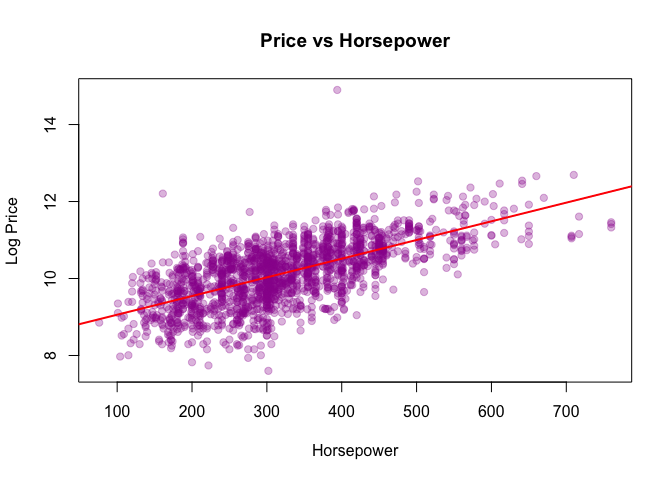

Horsepower

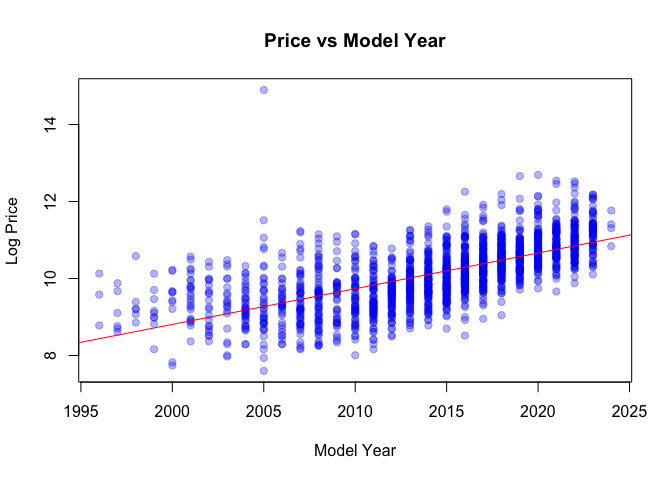

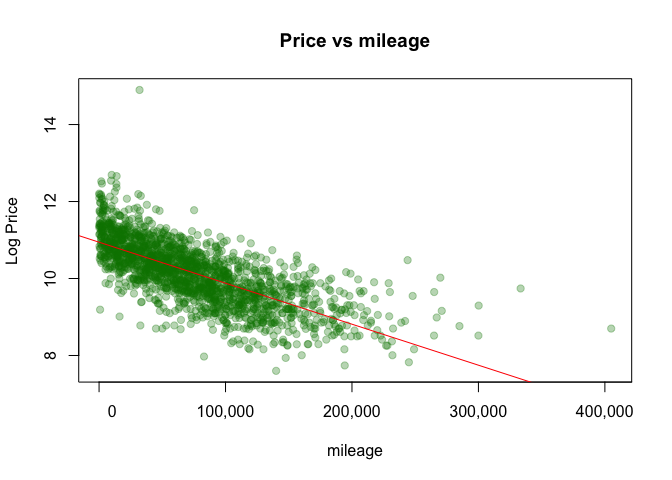

Model year and mileage

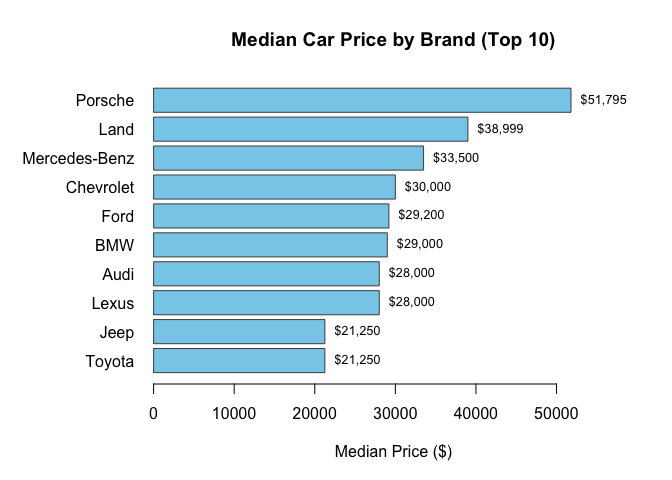

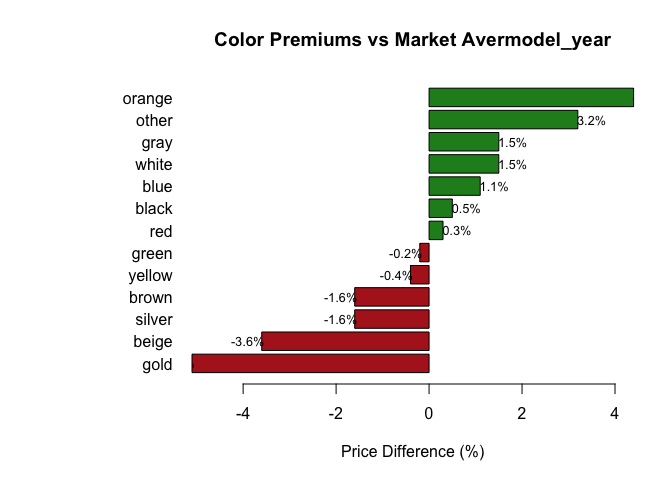

Brand and color

Takeaways: newer cars and lower mileage command higher prices; brand effects persist after controls; extreme HP has diminishing returns.

Modeling approach

Train/test split 80/20 on log(price). Compared:

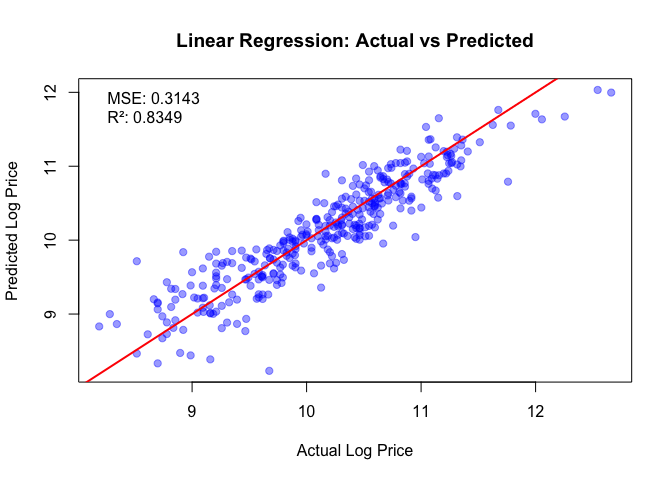

- Linear, Ridge, Lasso

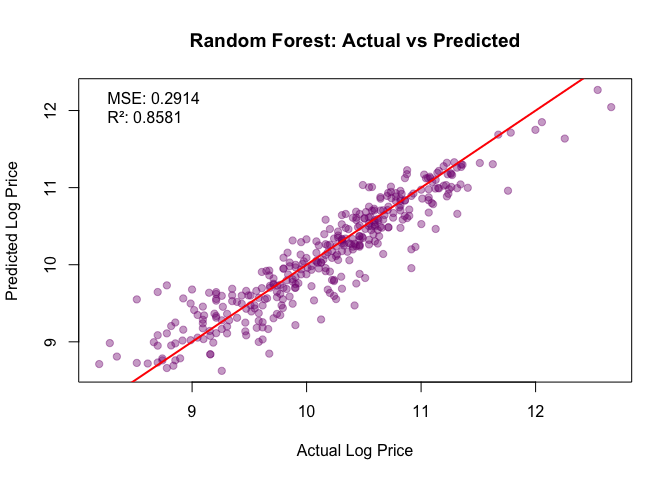

- Random Forest (RF)

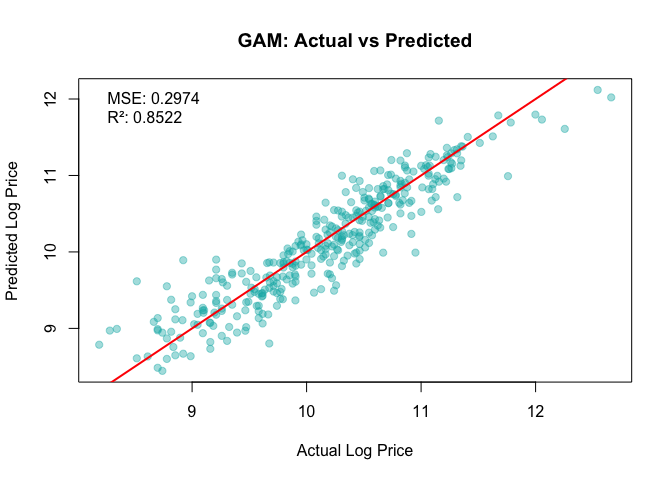

- Generalized Additive Model (GAM)

- Gradient Boosted Trees (GBM)

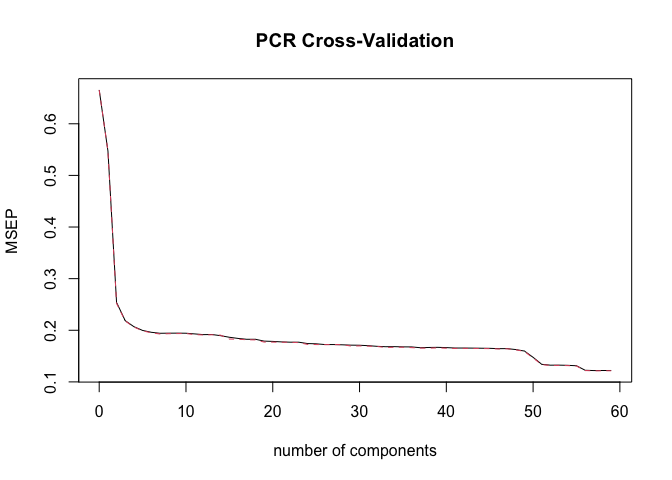

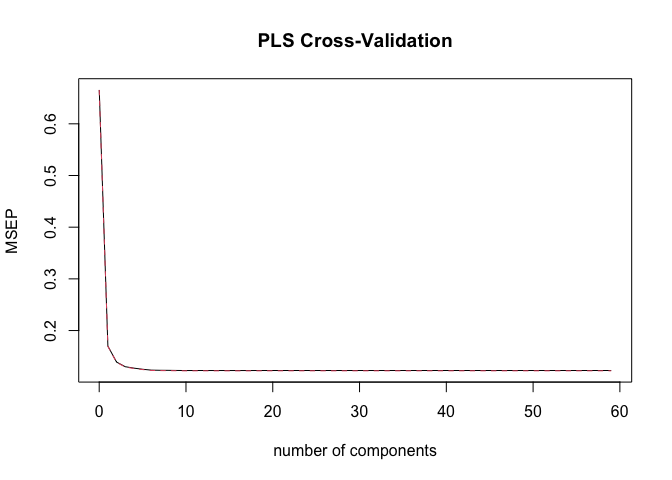

- Classical feature screens: Best Subset, Stepwise, PCR, PLS

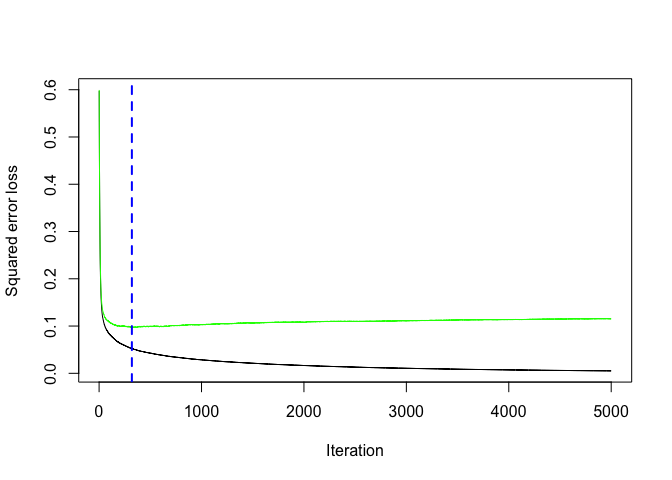

Cross-validation examples:

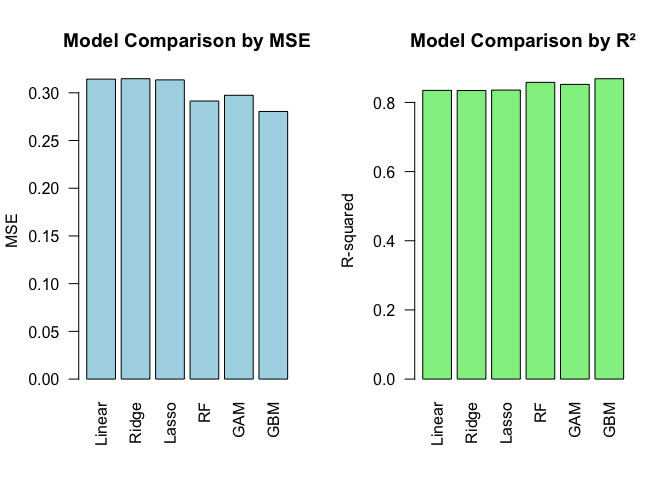

Results

Model comparison

Best model: GBM

Benchmarks

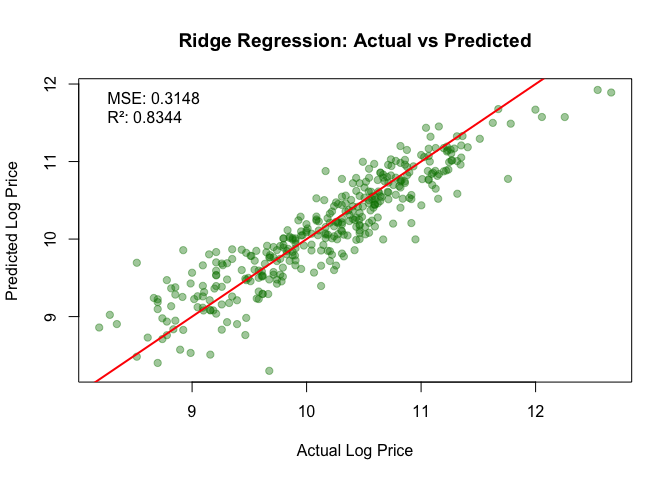

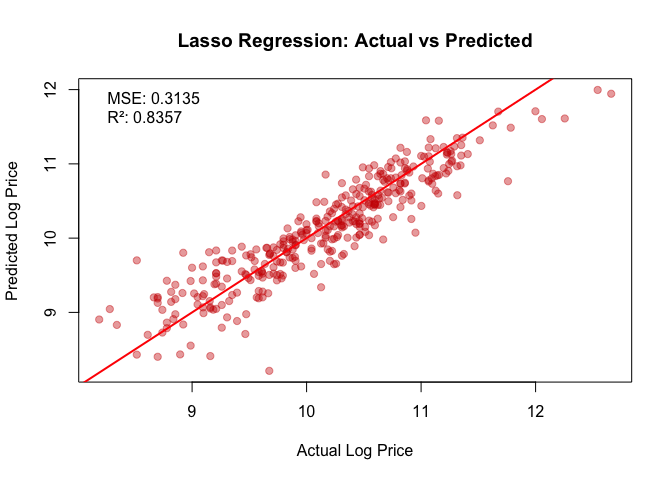

- Linear/Ridge/Lasso: good but miss nonlinearity.

- RF and GAM: competitive, interpretable effects.

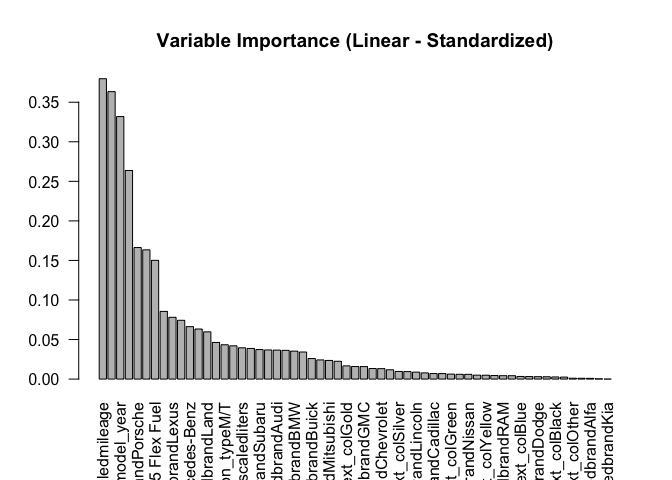

What drives price (business view)

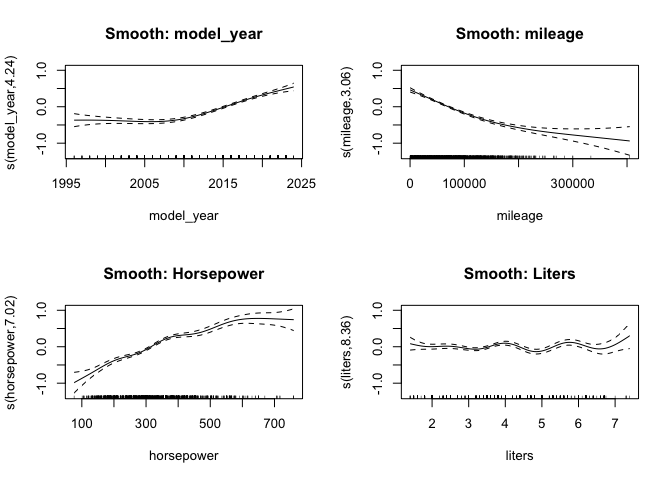

- Mileage dominates: large, monotonic drop from ~50k to 100k; tapering beyond 200k.

- Model year: step-up for ~2015+ inventory.

- Powertrain: horsepower helps until mid-high ranges; diminishing returns afterward.

- Brand equity: Porsche, Lexus, Toyota retain value; Dodge/Chrysler lag.

- Low-leverage features: color, transmission label, accident flag add little once core factors included.

Limitations and next steps

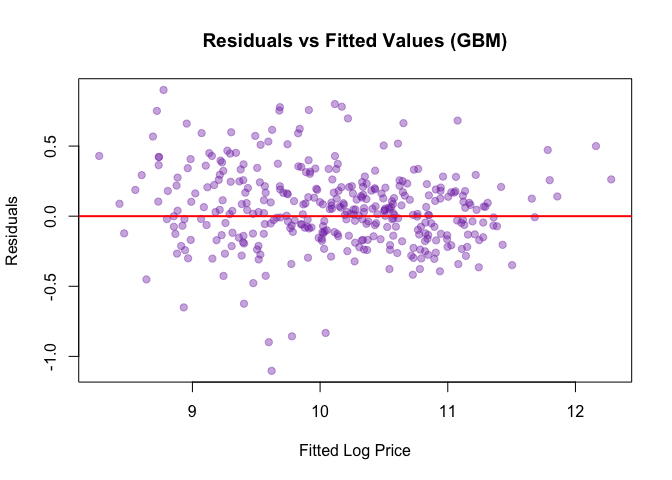

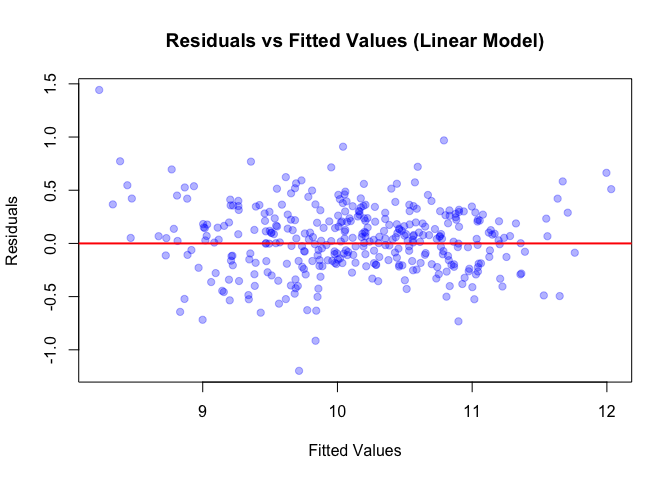

- Tail errors: more variance on very cheap cars; rare categories (e.g., colors) are sparse.

- Add features if available: condition grades, owners, service history, trim, options, market signals.

- Monitor drift; retrain with newer sales cycles.

Appendix: more figures

Linear residuals:

Linear standardized importance:

Ridge A vs P:

Lasso A vs P:

GBM CV curve:

Files produced

- Predictions CSV:

id, pricefor 1,000 test cars (log-price). - Code: single R file with all steps and seeds.